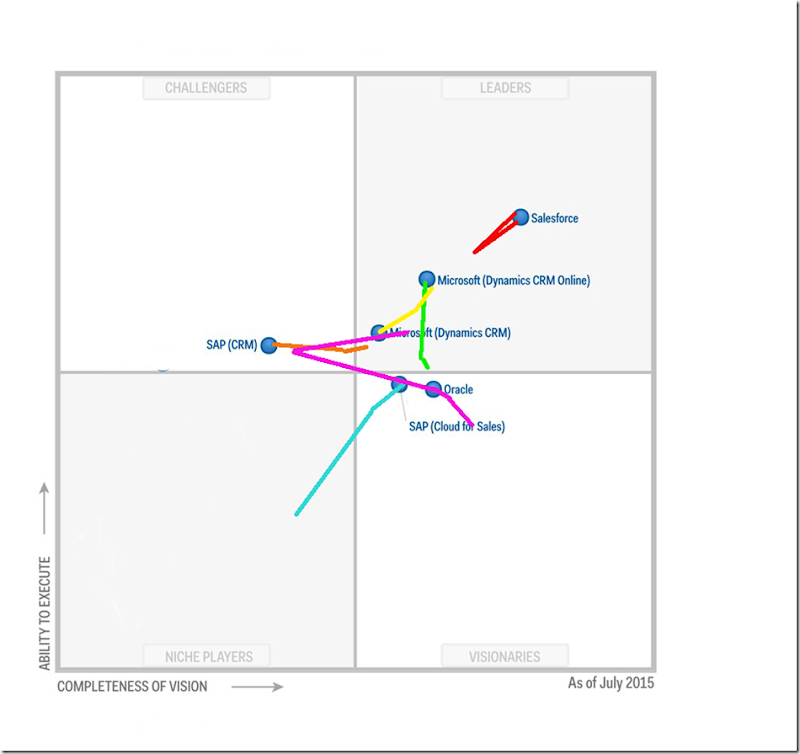

When Forrester or Gartner release their ‘quadrants’, rather than looking at the ‘winners’, I like to see how the products have fared over time. I have done this over the years and if you search for Gartner or Forrester in my blogs you will see them. Here is my most recent Forrester one and my most recent Gartner one. Thankfully my GIMP skills have improved over the years so the graphs are more readable these days.

With the relatively recent release of the Gartner Sales Force Automation Magic Quadrant, I thought I would construct another for the last three years of Gartner reports.

The big blue dots are where the products are in the more recent Gartner report. The tail shows the movement over the previous two reports. While Gartner has many more products in their reports, I have focussed on the vendors which, in the three years, have made a presence in the top right quadrant.

Let us look in detail at the CRM products which made the cut.

The Leaders

From two years ago, there has been a reduction in the membership of the Leaders Club. Back in 2013, there were four products, vying for the top spot:

- Salesforce

- Dynamics CRM (Online and On-Premise)

- SAP (CRM)

- Oracle (Siebel CRM)

Today only the top two of these remain. This also makes Microsoft’s play for Salesforce a little clearer. If Microsoft had succeeded in acquiring Salesforce, they would have dominated the Leaders quadrant.

Salesforce

The product to chase, Salesforce has remained in the top spot for the last three years. While others are getting closer, there is no doubt that for sales force automation, Salesforce is the tool of choice. Despite being firmly in the Dynamics CRM camp, I can understand this position. Salesforce was built to manage sales pipelines and sales opportunities and there is no reason to believe it does not do the job. However, for xRM-like processes i.e. customer interactions outside of a traditional sale scenario, my belief is Dynamics CRM does a better job and Salesforce needs the force.com/app cloud platform to get close. However, this is a Gartner report for sales force automation and Salesforce reigns supreme.

Dynamics CRM Online

The online version of Microsoft’s product has gone from strength to strength under the guidance of Jujhar Singh, General Manager for Dynamics CRM. Three years ago development of the product was not as tight; deadlines were missed and bugs sometimes slipped out, leading to release withdrawals and the like. There was also times when functionality was released to help Dynamics CRM demo well, rather than because it added sustainable value to the product. With Jujhar, this has gone away; development is a lot tighter with the consistent release of added functionality for long term user benefit.

The consistent improvement in the positioning of CRM Online in the Gartner Quadrant is a testament to the focussed efforts of the Dynamics CRM development team.

Dynamics CRM On-Premise

While still in the leaders quadrant, the On-premise version of Dynamics CRM has slipped back a bit. Given Gartner release their results in July, when CRM Online has the new features but CRM On-Premise does not (the two products realign with the November-December release, this explains some of the slippage, although not entirely. The Gartner report suggests slippage is also due to customer satisfaction and the annual update release cycle, compared to CRM Online’s cycle which is every six months.

The Challengers

SAP (CRM)

This is SAP’s on-premise offering and it has moved out of the leaders quadrant and into the Challengers, with the completeness of their vision being left behind the others. Gartner cites the reason for this is that SAP is focussing on their cloud CRM product, SAP (Cloud for Sales). In other words, while SAP (CRM) will likely be retained in the foreseeable future, it is not necessarily a key component of their market strategy.

The Visionaries

In this case, a visionary is a vendor with a clear vision for the future but not necessarily a full set of features in the product.

SAP (Cloud for Sales)

The cloud CRM offering from SAP is going from strength to strength. Starting out in the bottom left (politely characterised as ‘niche players’), it is now a Visionary. It seems SAP’s shift in focus from their on-premise offering to their cloud offering is paying off. It will be interesting to see if SAP can make it back into the Leaders club next year.

Oracle

In previous quadrants, Oracle had two products, Siebel CRM and Sales Cloud. Oracle have announced that the once 200-Pound gorilla of the CRM market, Siebel CRM, will no longer be sold to new customers. Therefore, the Sales Cloud is the only product now being considered by Gartner.

The tail coming from the south east of the Oracle dot is the Sales Cloud one. Therefore, we can see that the Sales Cloud, for the last three years has been residing in the Visionaries quadrant. Perhaps, like SAP, with increased focus on this offering, Oracle will again gain a foothold in the Leaders quadrant.

Conclusions

Since 2013, the Sales Force Automation landscape has changed from being dominated by four vendors to just two, Salesforce and Microsoft. SAP and Oracle are seeking to return with their cloud offerings and only time will tell if they have come to the party too late to make their mark. SAP are certainly making progress but Oracle are still struggling to make significant gains.

As for the leaders, Salesforce still holds the top position but Dynamics CRM Online is rising fast and, with CRM 2016 soon to be released, perhaps this will be enough to challenge the incumbent, just as the CRM systems of old have been challenged and left behind.